Being £50,000+ in debt, self-employed and watching our finances drop off a cliffs edge when the pandemic first hit, was certainly a severe reality check. Living month to month with no savings in the bank, credit card debt, mortgages and loan repayments coming out of our ears. And no way in which to repay them, was really scary shit!

It was one of those wake-up moments where I got to the point where I said, enough is enough. The constant cycle of debt and living month to month has to stop! There has to be a better way and I am going to do something about this, for us and the future of our family.

During the very start of the pandemic in 2020, in what feels like a lifetime ago and yet only the other day all at the same time. I decided I wanted to learn more about financial stability. We were in a rut after selling up and moving to a new country in 2016, starting a business that was a massive error in judgment and sucked up the majority of our life savings. We had got in deep and we wanted out!

I have to preface this piece by saying I am in no way giving financial advice or pretending to be an expert. I am simply sharing the steps that have felt incredibly empowering after being in a really scary place financially when the pandemic first hit.

In my search for answers on where to start, I stumbled across Dave Ramsey and his baby steps. The steps become pretty infamous and have helped many people.

Dave Ramseys Baby Steps are:

- $1000 emergency fund

- Pay off debt using the snowball method

- Work on 3–6 months of living expenses

- Invest 15% of household income in pensions/retirement funds

- College/University funds

- Pay off home early

- Choose to be generous and give

I love the idea of this systematic approach, but at the same time it felt so ridged as you must follow the first 3 steps in order. As though I would have to be completely frugal and basically live just to save up every penny. It didn’t fully align with my own values for how I want to live my life.

Youtube’s algorithm lead me to later discover UK based finance expert and her Youtube channel Mama FurFur AKA Jennifer Kempson. Jennifer not only being from the UK, a woman, but also a little more down to earth and her videos’ resonated with me so much more.

I devoured hours of her Youtube videos and was determined that I was going use this advice to get out of the financial hole that we had dug ourselves into.

At the time Jennifer was still working in a corporate job and her Youtube channel had around 10k followers. I was desperate to know more and so I decided to reach out and request an interview from her. I was delighted when she accepted, leading to an incredibly insightful conversation.

Since the interview, Jennifer has gone on to grow her channel to over 92k subscribers, retired from her corporate job and is now a full time multiple 6 figure content creator in the finance sector.

I caught her just as she was on the rise and am grateful to have been able to get this one-on-one time with her. And thanks to the tools that I took from this powerful conversation, two years later we are indeed in a much better place with our finances.

If you prefer to watch in video format, you can watch part one of the interview below, or read on as I summarise some of the key steps that helped me the most on my financial journey and my own application of the steps

My financial goals are still very much a work in progress, we still have a long way to go but some significant progress has been made over the last two years. We are no longer crippled by the fear or the debt that was hanging over our heads.

The steps that I’ll be sharing are Jennifer’s top tips for managing your money during times of crisis which we discussed two years ago. But let’s face it, the world as we know it now seems to be one crisis after another. If it’s not a global pandemic, it’s a potential world war, the rising cost of living and escalating fuel prices. Even two years on, this conversation is still incredibly relevant.

So I hope that this information can help you as much as it’s helped me over the last few years.

Steps For Managing Your Money During Times Of Crisis

1. Know Your Bare Bones Budget

How much do you need for the bare essentials? To keep a roof over your head, the lights on and food in your belly. Your most basic outgoings only. What is your survival mode amount?

Then work out your total household income, exactly yhow much do you have coming in each month? If there is a surplus you know you can breathe and manage it by making a few cutbacks on luxuries.

If there is a deficit, you have more going out than you have coming in, then go on to step two.

2. List 25 Ways To Solve It

Write out 25 ways in which you could bring in more income right now? List out as many ideas as you can that could bring in some extra cash as quickly as possible.

These could be things like reselling old items on ebay or any re-sale site, getting another job, creating or selling courses, writing on Medium, Deliveroo driver, Amazon flex, look for any job or offer your services. Leave your ego at the door and look at what options you have. List out as many ideas as you can.

When you have your list, pick one that feels most relevant to you and action them. If you are already working for yourself, look at what’s working and double down on that, look at what you can amplify.

What worked for me

I had a clear-out and sold things, cashing in on anything that was lying around in my house unused and cluttering up space. From a camera I never got around to learning how to use, a pair of Louboutins (as gorgeous as those shoes were, they are completely useless in my new life in the mountains), an old phone, books, clothes that no longer fit. Anything that wasn’t serving my life anymore, I got rid of. It wasn’t huge amounts, maybe just over £500, but it was cash in my pocket, rather than items cluttering up my house. This money could then be used to support the weekly essentials.

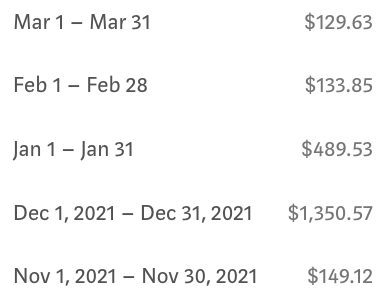

I also started writing here on Medium. Though it’s certainly not a get quick rich scheme, the monthly income has been welcomed. Though it has been up and down, my highest earning month at $1,350, it certainly has potential.

If you want to consider waiting on Medium then use my referral link and join below. I get a small referral fee if you join and you get unlimited access to many amazing writers, plus the opportunity to use medium to create your own side hustle. Join Medium with my referral link – Emma Colsey-NichollsAs a Medium member, a portion of your membership fee goes to writers you read, and you get full access to every story…emmacolseynicholls.medium.com

3. Pay Down Long-Standing Debt

Get specific on what your exact amounts are, even if that means having to phone up the companies and have a clear number of that balances, interest rates and the minimum monthly payments.

From there you can calculate how long it will systematically take for you to pay off that debt. You can find calculators with a quick google search that will help you do that. Know your debt-free date and have that goal date as your driving reason. I know looking at my debt-free date, it was way too far in the future and it was the severe kick up the backside to shake me into action.

This is about taking ownership of your debt and deciding that it’s done, you are not going to make yourself feel bad about it, but are committing to getting it down and not going back to it ever again.

I made the decision to cut up all of my credit cards and closed the accounts as they got paid off. I now only have one card for emergencies only.

Avalanche v’s Snowball method

Jennifer recommends the avalanche method as appose to the snowball. This can be quicker and more cost-effective as it looks at paying off your most costly debts first and foremost. Reducing the amount of interest you pay overall and potentially shortening the repayment period depending on how much debt you have.

We still have a few loans outstanding for some property improvements and vehicles but they are due to be paid off within the next 12 months.

4. Know Your Numbers

This one really relates to all of the previous other steps. Get to know your numbers. Know what’s coming in versus what’s going out and commit to running a tighter ship with your numbers.

This one is certainly a work in progress, I seem to have some aversion to spreadsheets and being too frugal. But I do slow down when considering purchases and have stopped impulse buying. Now if I find myself wanting to buy something I wait at least 48 hours before purchasing, I’ll even journal on it to really consider if it’s something that I really need. If I decide it is, then I have to be able to pay cash for it. If I can’t, then I have to earn the money first before I can purchase the thing. No more sticking it on the credit card.

Track your spending for a week, write everything down and see where the money leaks could be and where you could put a plug in those leaks.

5. Practice Your Best Money Habits Now

Think about all of the best practice money habits that you would love to be practising. Start doing them now rather than waiting.

For me personally, I knew I wanted to be saving regularly and also investing.

I now have an emergency fund in savings as my safety net and have tentatively started the route of investing.

I set up a standing order to go from my everyday account into a savings account. I started out with a really small amount of just £5 per week. I didn’t really notice it going out and it was just adding to my savings on autopilot. I would then top it up as often as I could which allowed me to get to my £1000 savings buffer much quicker. As you earn more you can start adding more, but having it on automation was such a game-changer for me to just get started.

Next, I also added the ‘save spare change’ setting on my Revolut card (note this is a refer a friend link). So every time I spend on that card it puts 10 x the change of my purchase into a savings vault. I love this card as it’s so easy to use and can spend in multiple currencies. This vault would then help me pay for things like kids birthdays and Christmas without having to go onto credit.

Starting Investing

I had been putting off investing for such a long time as I feel I don’t know enough about it. I still don’t know enough about it but have committed to learning the basics and starting small with low-cost index funds.

I choose to use the Freetrade app as it’s pretty easy to use and you get a free share when signing up. (Again this is a referral link and we both get a free share if you decide to join and it’s free to get going).

I know it feels a little risky to be investing right now. But when you look at it from the other point of view, the markets have taken a bit of a dip, it could also be the best time to start investing.

This one shouldn’t be stepped into lightly as you do have the potential to lose money. So start learning about investing from as many places as you can and prioritise investing in your future now.

Some of my favourite Youtube accounts for learning more about investing are:

If you are feeling the pressure of challenging finances right now I hope this gives you the information and motivation to know you can change your current circumstances with the grit and determination to make a difference in your life.

If you have had any of your own financial breakthroughs let me know in the comments as it’s an area I am constantly open to learning more about.

Emma

Leave a Reply